The Big Short by Michael Lewis is probably the best book (or at least the most entertaining book) about the origins of the financial crisis of 2008. But how would you go about making a movie of it, given that most of the audience will not be interested in a lesson on fixed-income derivatives? Maybe you could have Selena Gomez pop up and explain how CDOs work?

Actually this works surprisingly well. I found the movie version (IMDB) to be quite funny and entertaining as well as sobering.

The movie focuses on a few small-time fund managers who noticed a few years back that the economy had become increasingly dependent on a pyramid of complex financial instruments based ultimately on subprime mortgages (which had come to mean “loans to people who can’t afford to pay them back.”)

In theory this is how capitalism is supposed to work: when a bubble starts to form some far-sighted investors will notice that the assets are overpriced and will bet against them, thus puncturing the bubble before it gets too bad while making a tidy profit for themselves. In practice when you have thousands of well-connected mediocrities who are earning multi-million dollar bonuses and who have convinced themselves that these are well-deserved because they have discovered a magic risk-free formula for creating wealth out of thin air, then a bubble can resist popping until it has grown to catastrophic proportions.

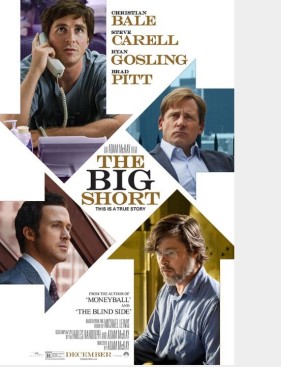

The closest thing to a hero in the movie is Michael Burry MD (Christian Bale) a one-eyed former physician turned small-time hedge fund manager. Obsessed with numbers, he spots a disturbing pattern in the real estate market and searches obsessively for a way to profit from it, ignoring all the older and wiser people who try to dissuade him. (Burry is obviously somewhat autistic which may explain why he is the only major character who allowed his real name to be used in the movie.)

Jared Vennett (Ryan Gosling) is a securities dealer who pioneers the market for credit default swaps, a way to bet against the real estate market. (These are very dangerous investments. Investors risk losing a lot of money if the bubble lasts longer than they expect, and they are subject to manipulation by the big banks that issue them.)

Vennett serves as the movie’s narrator and livens up the proceedings by constantly breaking the fourth wall with cynical witticisms.

A misdirected phone call from Vennett alerts Mark Baum (Steve Carell) to what is going on. Baum, an investment manager with an anger-management problem, launches an investigation into what is really going on in the real estate market. What he finds makes him even more angry.

Jamie Shipley (John Magaro) and Charlie Geller (Finn Wittrock) are recent college graduates who dream of being Wall Street wiz kids. They figure out what is going on but they lack the experience and connections needed to get in on the game. So they seek the help of Ben Rickert (Brad Pitt) a burned-out retired banker.

Rickert serves as the conscience of the movie, the only one to point out that this isn’t just a lucrative (though risky) investment opportunity. When the house of cards collapses the lives of millions of innocent people will be devastated.

Watching the movie is like watching a slow-motion train wreck. We know, in broad outline, what will happen. What we don’t know is whether the protagonists will get rich or whether they will be outsmarted and ruined by the powerful interests they are betting against.

Full disclosure: I had read the book which gave me a head start in following the action, even though the details in the movie are somewhat fictionalized with names changed to protect the guilty, etc. I think someone who has not read the book should still be able to follow the movie but your mileage may vary depending on how interested you are in this sort of thing.

Loved the movie and your review is excellent. Would like to think its revelation of banking fraud might help Bernie or some reform effory.